Panel discusses why U.S. VC money flies over Japan

On October 20, the SPRIE-Stanford Project on Japanese Entrepreneurship (STAJE) hosted a panel discussion featuring venture capitalists and a group of U.S.-Japan experts. The discussion with the title, "U.S.-Japan VC Cooperation and the Fly Over Phenomenon" was moderated by SPRIE Researcher, Robert Eberhart and held at the Stanford Graduate School of Business.

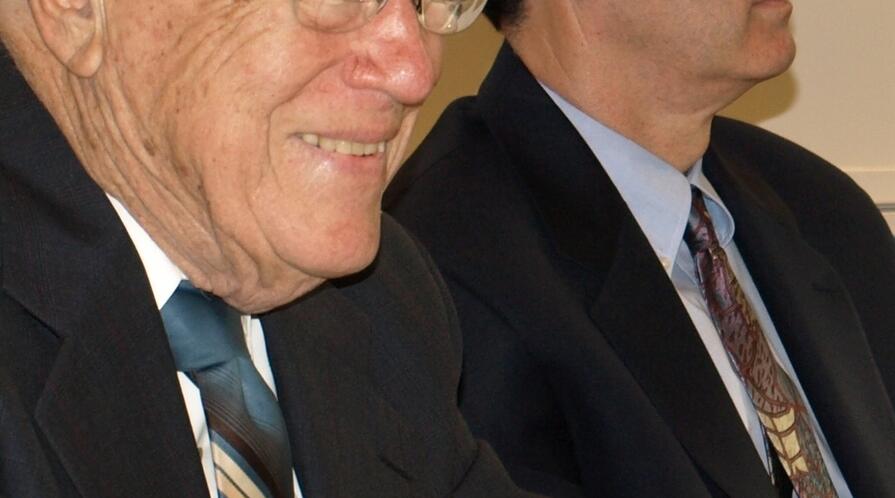

Panelists included Michael Alfant, CEO of Fusion Systems, Martin Kenney, Professor at UC Davis, Allen Miner, Founder of SunBridge, Scott Ellman, CEO of USAsia Venture Partners, Quaeed Motiwala, Managing Director at DFJ JAIC, and William F. Miller, Co-director of SPRIE. They discussed the tendency of U.S. based venture capital firms to fly from Silicon Valley, over Japan, and invest into China.

The panel noted that the reasons usually given by U.S. venture capitalists for the flyover phenomemon is that Japan has obscure accounting, uncertain relief in courts, and too far away to monitor. But since those risks are much larger in China other explanations were needed. The lack of innovation - i.e. copycat firms - that flourish in new niches in China are more attractive for VCs than the highly competitive and risky new technologies in Japan. Panelist also suggested that investing cycles are dominated by "fashion" with Japan being out of fashion, and noted the late stage investing pattern in China versus earlier stage investing in Japan and the U.S. Finally, the panel posed an interesting question for STAJE research that perhaps under certain circumstances protected markets that are now in China might reduce the risks and increase returns for venture capitalists.